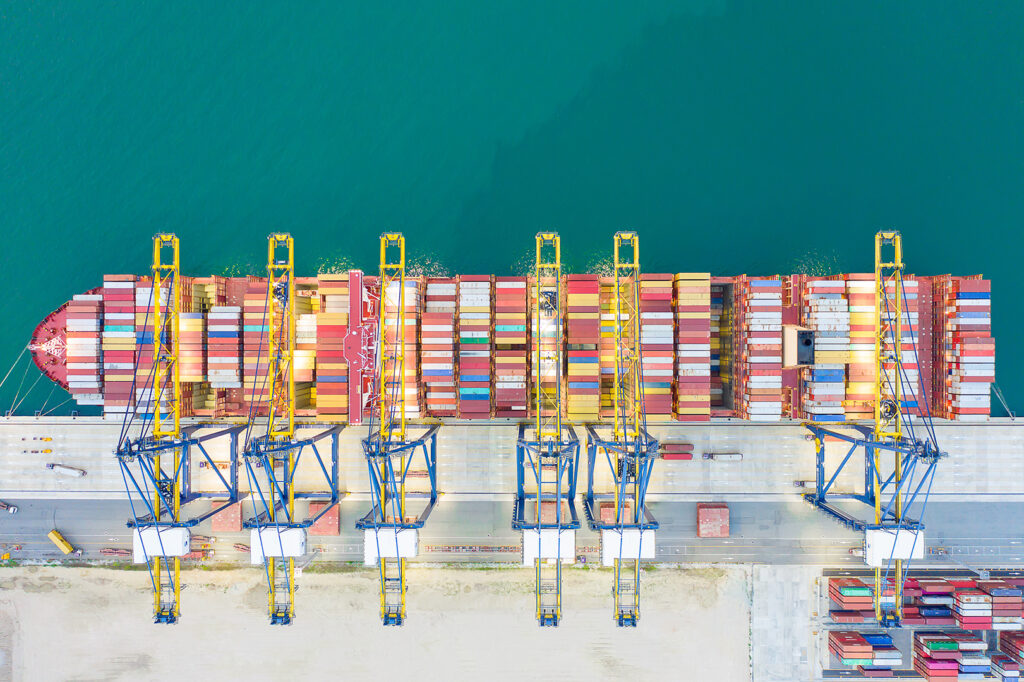

Import Export Business in India

Import Export Business in India

The import-export business in India has already been proved to be more remunerative since the inception of e-commerce as it endorses the business to reach the audience in the global platform. The import-export business India is considered as one of the lucrative businesses because of the high demand for goods and services in international market Business loving enthusiasts are now seen to be venturing into this. In order to make your business more profitable you must gain good knowledge about your business, veritable relations and strong contacts. So, if you have already made your mind to venture out into the export-import business in India, certain things need to be taken care of.

Some pre-requisites to kick-off the Biz

A business set up: Incipiently you need to have your own business set up. It is imperative to initiate the process with a sole proprietorship by getting your Trade License, a Service Tax registration and business logo

Pan Card: Its pre-requisite to obtain a Pan Card to comply with the Tax-Laws.

Register your business: Now you need to get your business registered with the government of India regardless of your business is a sole proprietorship, a private limited company, or a partnership business. Obtaining a Service Tax registration certificate is also very vital. Guidance from the lawyer can be sought out to complete these steps.

Current account: To run the business transaction you must hold a current account.

IEC code: IEC is a mandatory unique 10-digit code for import and export from India. It is considered to be the key business identification number which is exigent for export from India or Import to India. It is obtained from the Director General of Foreign Trade (DGFT) and has a lifetime validity. To acquire IEC code the necessary documents that you need to provide are Permanent account Number (PAN), photo and a copy of cheque leaf form the business account (Current Account).

RCMC: Immediately after getting the IEC, it is recommended to obtain the Registration-cum-Membership-Certificate (RCMC) from the Export Promotion Councils. Once both these IEC and RCMC are attained, you are all et to kick-off your import-export business in India.

Logistics: This is treated as the most vital part of your business. It’s mandatory to make sure that your logistics are in place, so that products can be delivered worldwide at stingy shipping charges.

Customs clearing agent: Customs clearing agent is the one who has official permission to deal with the customs on behalf of another person, conduct customs beadledoms related to importation, exportation and as a whole the movement and storage of ladings within the customs territory of a given country.

One basics guidance

Let’s assume you are starting your export-import business in India supposedly with minimal funds and be on the safe side. It’s fairly good enough to aim for a good flow of business, but at the end of the day it only demands your incessant and equitable efforts and hard labour. In the Export-Import Business, you must not take shortcuts. You must first learn & then waggle the trade though your product respectively. Having a sound knowledge of your work and the product is most important.

Related Posts

- 1800 309 0819

- contact@subhajitmondal.net

- Saltlake, Sector V, Kolkata- 700091

- Kensington,London,England,W86BD